Blockchain security is achieved by implementing cybersecurity techniques, developer, and user best practices on the various blockchain layers.

Learn DeFi · Anything · Anytime

Blockchain security is achieved by implementing cybersecurity techniques, developer, and user best practices on the various blockchain layers.

As blockchain technology disrupts several large industries and institutions (like finance and governance), its extended applications naturally come with several attack vectors.

Crypto launchpads are platforms that allow for anyone to participate in the initial private sale of new tokens or projects.

Farming in DeFi can also be referred to as liquidity mining, and help protocols kickstart the liquidity of a newly released token pair.

Soulbound tokens (SBTs) are non-transferable NFTs that enable users to have a decentralized identity tied to their wallets.

The stablecoin trilemma speculates that each stablecoin currently on the market requires a trade-off between varying degrees of decentralization, price stability, and capital efficiency.

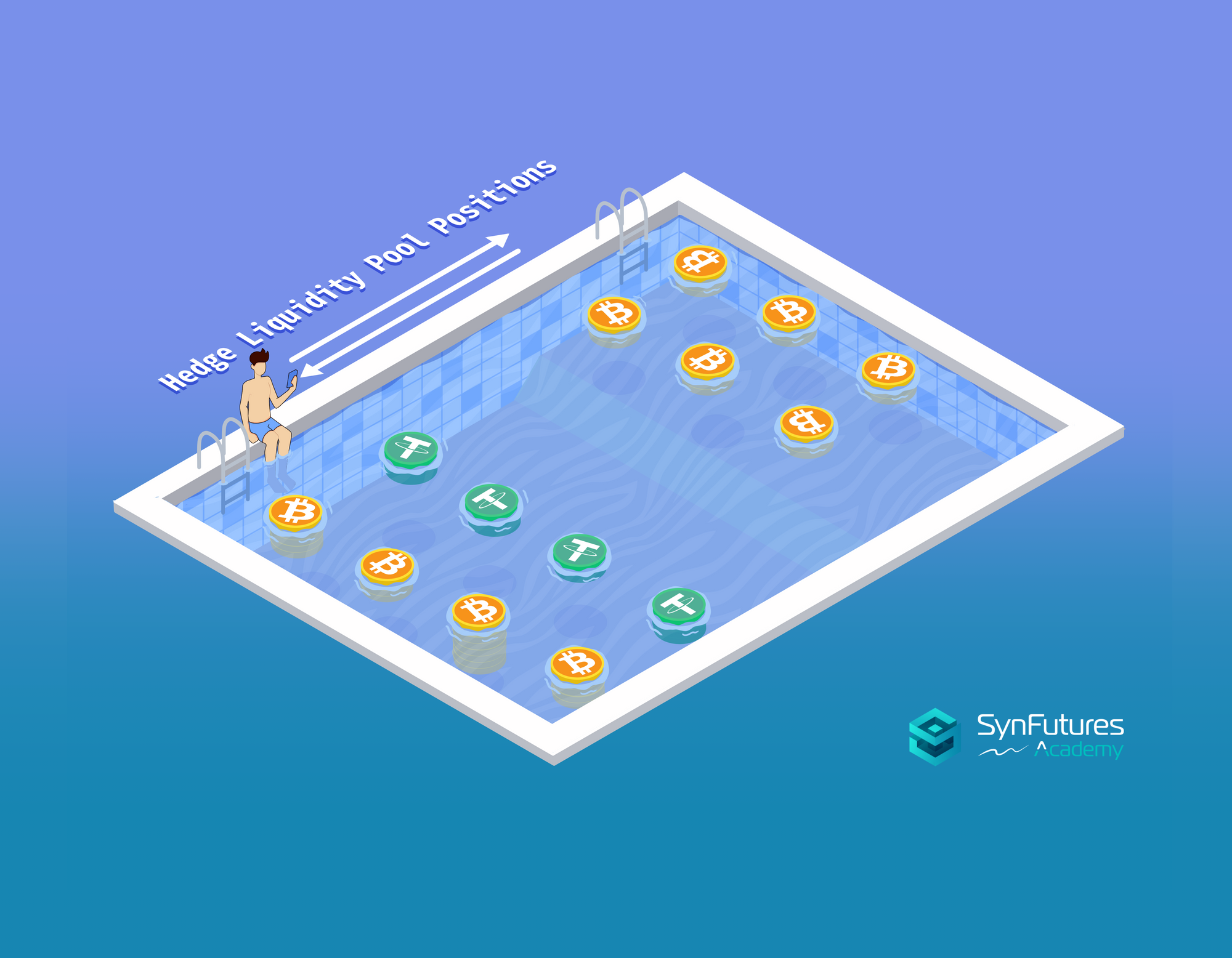

Liquidity providers can hedge their liquidity pool positions by utilizing futures or lending and borrowing platforms.

A fork is the divergence of a blockchain into different chains with different rules. Reasons for a fork include technical updates, community cultural differences, developer preferences, etc.

Every trader is a maker or taker at any point in the market, and being one depends on their current preference for immediacy or future entry target over the other.

There is a wide variety of NFT platforms and products catering to different industries and audiences. Learn about Larva Labs, OpenSea, and other popular NFT platforms and products.