2025 was a year of acceleration at SynFutures.

From leading perps on Base, to expanding to RWAs, incubating new builders, and getting the F token listed on major CEXs, we’re proud of our team’s achievements this year. But if this seems exciting, you’ll love what we've got planned for 2026.

Before we jump into 2026, let’s look back at the journey we went through together this year.

Here’s a quarter-by-quarter look at what we shipped, our great partners, and how the community grew.

2025 by the Numbers

- Total trading volume on SynFutures in 2025: $73.8B

- Share of Base perp DEX volume at peak: 62.5%

- Number of perp markets listed via SynFutures Launchpad in 2025: 13

- New asset types added: Meme tokens, long-tail assets, and real-world asset (RWA) perps

- New centralized exchange listings: Binance and Upbit for $F

- SynFutures Community Campaigns: distributed $1.5M to over 10,000 participants

Q1 2025: Strength in the Core

Dominating Perps on Base

In Q1, SynFutures solidified its lead as the top decentralized perps DEX on Base.

- Processed over $34.1B in trading volume across Base and Blast

- Captured 62.5% of Base’s perp DEX market share at peak

- Continued to refine our Oyster AMM v2 design for tighter spreads and better capital efficiency

This was the quarter where SynFutures stopped being “another perp DEX on Base” and became the default venue for many traders.

Community-Driven Listings & Launchpad Growth

We doubled down on community and long-tail markets:

- Expanded listings with trending meme tokens and community-selected markets

- Brought 13 new perp markets live via the SynFutures Launchpad

- Helped partner projects bootstrap liquidity and discover product-market fit with perps

Whether it was a blue-chip crypto, a fast-moving meme, or a niche DeFi token, SynFutures kept markets open and accessible.

SynFutures V3 SDK Release

Q1 also saw the release of the SynFutures V3 SDK, a building block for the next wave of DeFi applications.

- Developers can now plug SynFutures perps into their apps with just a few lines of code

- Enables wallets, structured products, and new frontends to embed perp trading natively

- Sets the foundation for a more composable, integrated onchain trading stack

Q2 2025: Expansion and Incubation

Consolidating Liquidity on Base

To strengthen the trading experience, we made a strategic decision:

- Sunsetted support on Blast and consolidated liquidity fully on Base

- Improved depth, execution quality, and pricing across key perp pairs

- Simplified the trading flow while keeping gas costs manageable

Fewer fragmented pools. Stronger, more efficient liquidity where traders actually are.

Real-World Assets Arrive on SynFutures

Q2 was also when real-world assets (RWAs) arrived on SynFutures.

- Introduced RWA perps with up to 10x leverage and USDC settlement

- Gave DeFi traders an onchain way to express views on real-world markets

- Opened the door for institutional players looking to bridge TradFi and DeFi

For many users, this was their first time accessing RWA exposure in a fully permissionless environment.

Launching the SynFutures Builder Program

To support the next generation of DeFi products, we launched the SynFutures Builder Program:

- Offered teams infrastructure, liquidity, technical support, and go-to-market guidance

- Helped builders design sustainable perp-driven products instead of one-off experiments

- Created a pipeline of applications that extend SynFutures beyond a single interface

Monday Trade: The First Flagship Project

The first major outcome of the Builder Program? Monday Trade, a high-performance DEX for spot and perpetuals trading on Monad.

- Incubated within the SynFutures ecosystem

- Built for Monad’s high-throughput, low-latency environment

- Showcases how SynFutures infrastructure can power independent, branded trading venues

Monday Trade became the proof-of-concept for what builder-driven perps on new chains can look like.

Q3 2025: Building the Future

Doubling Down in Asia

Q3 was about deepening our presence in Asia and expanding brand footprints.

- SynFutures participated in major regional events like Korea Blockchain Week and other Asia-focused DeFi gatherings

- Hosted builder conversations and user meetups to align around the next phase of decentralized markets

- Strengthened relationships with local partners, media, and communities

This laid the groundwork for the dedicated Korea push that would officially launch in Q4.

Publishing the Manifesto for Future

We also took a step back to articulate where SynFutures is headed.

- Released the Manifesto for Future — our long-term vision for a unified, modular, onchain financial infrastructure

- Outlined how SynFutures will evolve in 2026 toward a smarter, more connected protocol layer

- Framed our direction around three pillars: programmable markets, unified liquidity, and global accessibility

For traders, it was a window into what’s coming. For builders, it was an invitation.

Ecosystem & Partner Growth

Across Q3, we continued to grow with key strategic partners:

- Collaborations with projects like Lido, Cygnus Finance, Mew, BLOCKLORDS, Virtuals Protocol, PumpBTC, and Solv Protocol

- Co-marketing, incentives, and joint liquidity initiatives to deepen onchain usage

- More ways for users to interact with the SynFutures stack — whether via games, DeFi tools, or yield strategies

Q4 2025: The Next Chapter Begins

$F Token Goes Global

The SynFutures ecosystem took a major step forward with new centralized listings:

- $F listed on Binance and Upbit, greatly expanding access for global traders

- Increased liquidity and visibility around the token and the SynFutures ecosystem as a whole

- Brought more users into the top of the funnel for DeFi derivatives

For many users, $F on Binance and Upbit was their first touchpoint with SynFutures.

Korea: A New Growth Engine

In November, the Korea team officially kicked off, and the response was immediate.

Offline & community initiatives:

- 160 participants at our first SynFutures Korea Community Meetup in Gangnam

- Community campaigns:

- Maeil Economy TV event: 249 participants

- Mascot contest: 133 participants

- Korea Trading Competition follow-up: 50 participants

- Korea community chat: grew to 362 members in a short period

- Telegram growth: from 3,655 → 4,079 members after bot cleanup (12.1% real growth)

Market traction in Korea:

- KR TV share rose from 23.72% in the first week of November to 42.71% by the fourth week

- Total $F supply held in Korea increased from 1,584,816,792 F → 1,691,691,972 F (6.74% growth)

For a team that officially started activities in November, this was a strong signal: Korea is becoming a key pillar of SynFutures’ global presence.

Launching the New Protocol Private Beta

This quarter also marked the beginning of SynFutures’ next evolution.

- We launched wave 1 of the Private Beta of our next-generation protocol upgrade

- Early testers gained access to:

- Improved liquidity efficiency

- Faster, smoother execution

- A more unified trading experience designed to scale beyond a single chain

This Private Beta is the bridge between today’s SynFutures and the future protocol that will go live in 2026.

Supporting Monday Trade’s Monad Mainnet Launch

Finally, Q4 highlighted the strength of the Builder Program:

- Monday Trade went live with perps on Monad mainnet from day one

- Supported by SynFutures infrastructure, expertise, and co-marketing

- Demonstrated how builder-incubated projects can stand on their own while staying part of the broader SynFutures ecosystem

Monday Trade’s mainnet launch showed what’s possible when protocol, builders, and ecosystems move in sync.

Looking Ahead: 2026 and Beyond

2025 wasn’t just a big year — it was a foundation-building year.

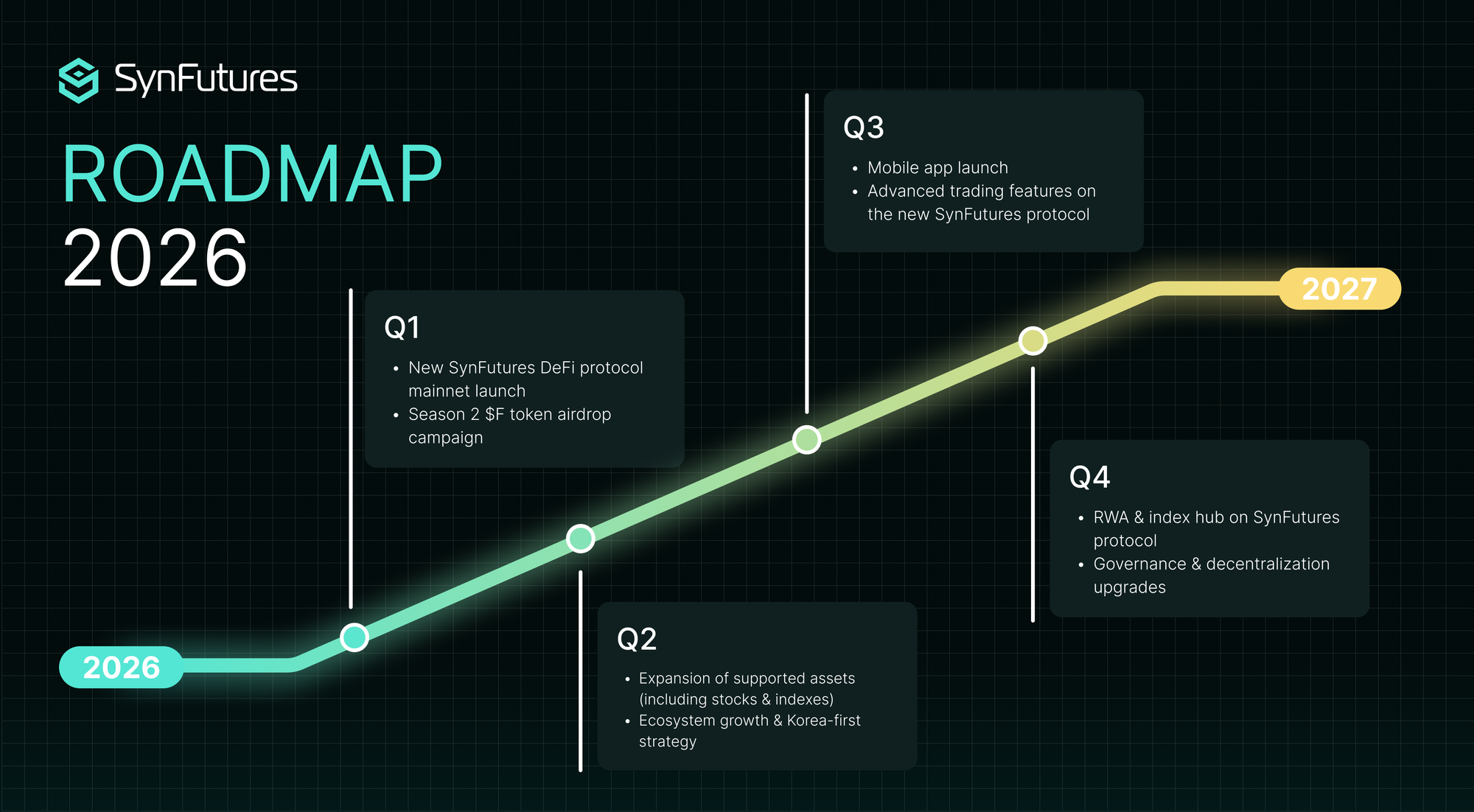

As we enter 2026, SynFutures is focused on:

- Moving from Private Beta to full launch of its upgraded protocol

- Expanding RWA and programmable perp markets, giving traders more ways to express views on real-world and onchain themes

- Scaling the Builder Program, so more teams can build independent products on top of SynFutures infrastructure

- Deepening our footprint in key regions like Korea, while continuing to serve global traders

We’re just getting started.

“We’ve always built for the long game. 2025 proved that decentralized finance isn’t slowing down, but it’s evolving. As we move into 2026, we’re taking everything we’ve learned to create a protocol that connects onchain markets with real-world assets in a unified, smarter ecosystem.”

Rachel Lin, Co-Founder and CEO of SynFutures

👉 Stay tuned for our 2026 roadmap and join the community shaping the future of decentralized markets.

Follow us on X, subscribe to our newsletter, and join the global community on Discord and the Korean community on Telegram to keep an eye on our blog for what’s next.