This article aims to help newcomers to futures trading understand the funding rate mechanism in perpetual contracts and how SynFutures' implementation differs from other exchanges. If you're already familiar with funding rates, feel free to skip ahead to the second section.

What is the Funding Rate in Perpetual Contracts?

Careful observation reveals that perpetual contract prices don't always match spot market prices, showing slight variations. While these differences can fluctuate in magnitude, prices typically hover around the spot price. Think of perpetual contract prices as shadows of spot prices—sometimes leading, sometimes following, but always orbiting the spot price.

Why does this happen? The answer lies in the funding rate mechanism. By periodically charging fees to traders who push prices away from the spot price and paying those fees to the opposite side, funding rates prevent contract prices from drifting too far from spot prices.

For example, if traders believe Bitcoin will rise over the next 3-6 months following a Trump victory, they might use leveraged perpetual contracts to go long on BTC. This increased demand for long positions can push contract prices above spot prices (say, $75,500 in the contract market versus $75,400 in the spot market). In this scenario, traders holding long positions must periodically pay funding fees to those holding short positions. The increased cost of maintaining long positions dampens traders' enthusiasm—some may decide against opening new long positions, while others might close existing ones. This helps prevent further price deviation and pulls contract prices back toward spot prices.

What would happen without funding rates? The market would become meaningless. Without funding rate constraints, the market would have no reason to maintain its connection to the underlying asset, defeating the purpose of a derivatives market.

Therefore, funding rates are the mechanism that ensures perpetual contract prices maintain a stable relationship with spot prices. When market sentiment is bullish and contract prices exceed spot prices, the funding rate is positive—longs pay shorts. Conversely, when sentiment is bearish and contract prices fall below spot prices, the funding rate is negative—shorts pay longs.

How Does SynFutures' Funding Rate Mechanism Work?

SynFutures operates differently from centralized exchanges due to smart contract limitations that prevent scheduled funding payments. Additionally, since liquidity providers (LPs) hold some positions, the funding rate mechanism differs from centralized exchanges (while achieving similar results).

Real-time Collection

When users trade, it triggers an update to the platform's funding rate, which in turn triggers the collection and payment of funding fees for all position holders. Since derivatives markets typically see continuous trading, this mechanism approaches real-time collection of funding fees.

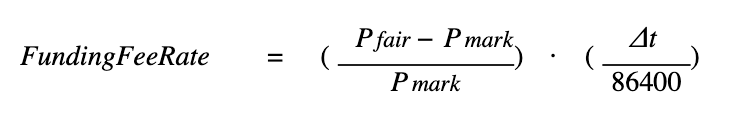

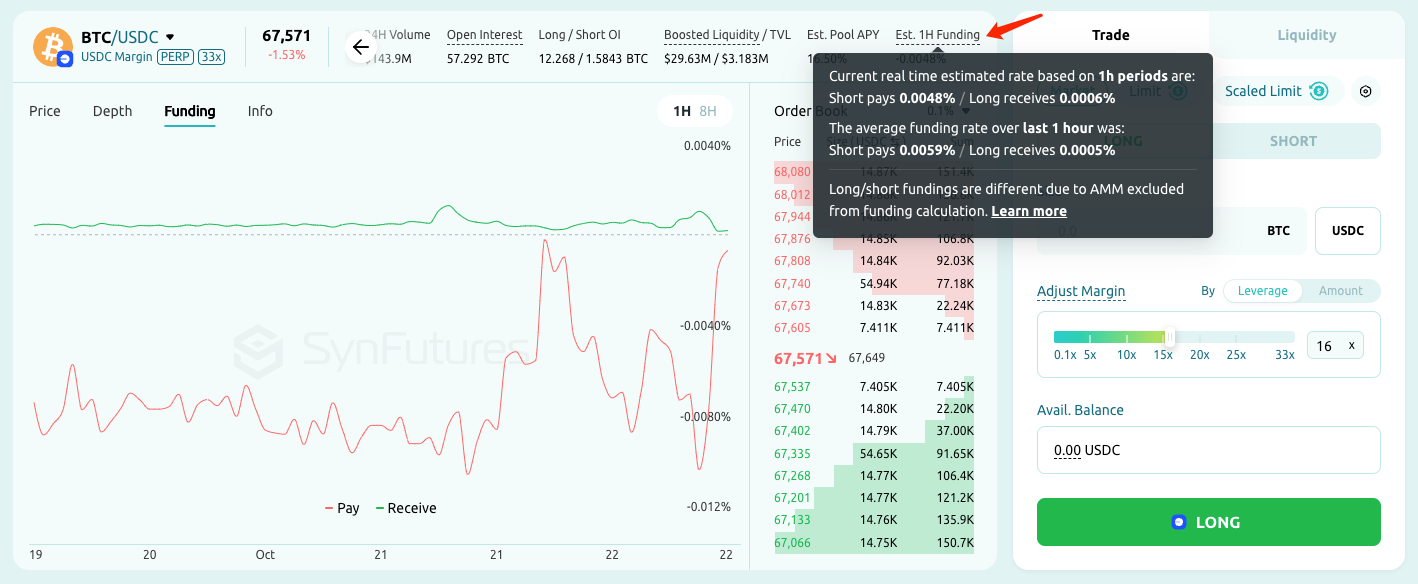

The funding rate is calculated using this formula:

Where Pfair represents the contract market price, Pmark represents the mark price, and △t is the time elapsed in seconds since the last funding rate collection (86,400 being the number of seconds in a day).

Asymmetric Funding Payments Between Longs and Shorts

When traders execute trades on SynFutures, LPs take the opposite position as counterparties. For instance, if a trader buys 1 BTC, the LP sells 1 BTC. Importantly, LPs who are still providing liquidity (including pending orders) don't participate in funding fee collection or payment. Unlike centralized exchanges, which don't have this LP position element, the amounts paid and received aren't always equal on SynFutures. The funding fee for the paying side equals position value * funding rate, distributed proportionally among recipients based on their position sizes.

For example:

- Funding rate: 0.02%

- Total long positions (excluding LPs): 10,000 USDC

- Total short positions (excluding LPs): 5,000 USDC

- User A's position: 2,500 USDC

When funding fees are processed:

- Total funding fee paid by longs: 10,000 USDC * 0.02% = 2 USDC

- Total funding fee received by shorts: 2 USDC

- User A's received funding fee: 2 * (2500 / 5000) = 1 USDC

Frequently Asked Questions About Funding Rates

What are Fair Price and Mark Price?

In the formula, Pfair (Fair Price) represents the latest market transaction price for the contract. Mark Price comes from third-party data sources like Chainlink (SynFutures smooths this price to prevent manipulation and oracle attacks). Funding calculations use the most recent Mark Price and Fair Price when triggered.

When are funding fees collected?

Due to smart contract limitations, SynFutures doesn't collect funding fees at fixed intervals. Instead, collection is triggered by any trade in the trading pair. In temporal terms, this roughly translates to funding fee collection and payment every block. These fees are recorded as Unrealized Funding until the user's next trade, when they become Realized Funding (viewable under History → Funding) and begin accumulating again.

Where can I view Funding history?

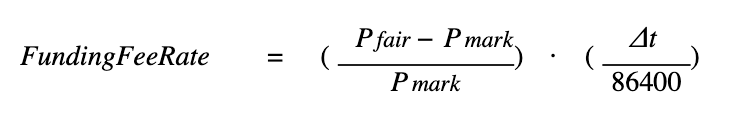

Users can view the past 3 days of Funding History in each trading pair's Funding Tab.

Does a negative funding rate mean shorts pay longs or longs pay shorts?

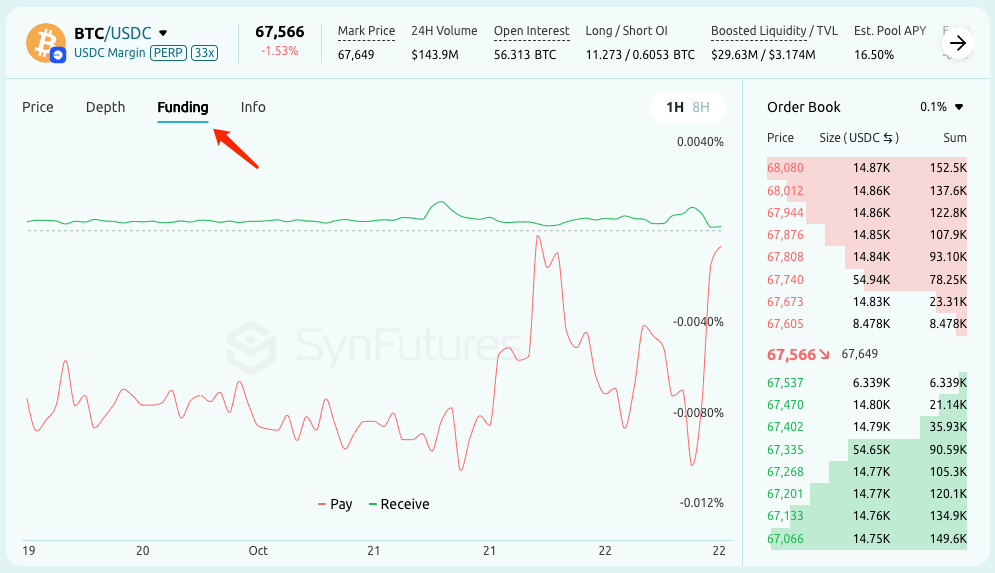

The platform displays the payer's Funding by default, so a negative Funding means shorts pay longs. Hover over Est. 1H Funding for detailed information.

If only 10% of my order was filled, will this portion receive funding rates?

Orders don't participate in Funding Fee collection or payment until they become actual positions.